If you are searching to possess quick financial help to obtain of the if you do not discover capital, it is possible to thought a connection financing. If you’ve considered purchasing home or need assistance investment a good work for your company, you might be wondering what a connection financing is actually. This short article give you the connection financing definition, make it easier to know how a bridge financing performs, and watch when to imagine bridge money for your needs.

What exactly is a connection Loan?

A connection mortgage, because of the definition, is a type of quick-term loan for usage in both individual and you will business financial support so you’re able to briefly link openings in investment (i.elizabeth. the period of time ranging from needing resource and obtaining they). Its most commonly included in case that you will be searching to invest in the acquisition regarding a residential property before you can has offered your current property. Bridge funding can help with the latest advance payment, like. However, there are also a number of other providers uses for bridge loans as better.

Because of the meaning, link money was small-term funding solutions having over-mediocre rates that always require you to created an resource while the guarantee.

How does a bridge Loan Functions?

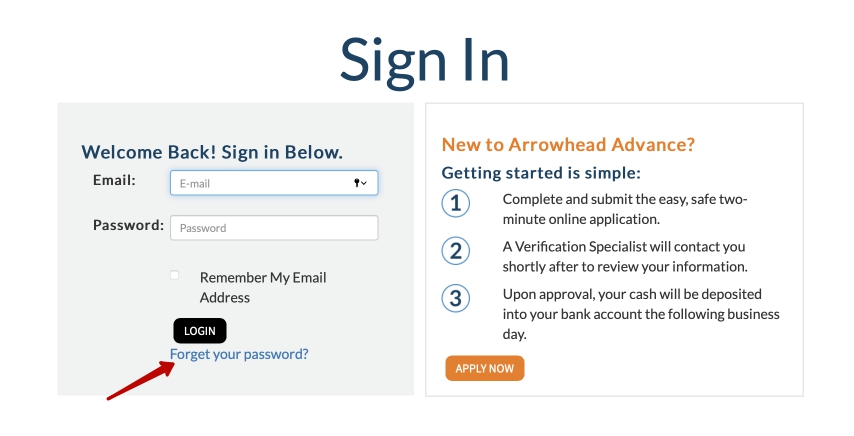

Therefore, how come a connection financing performs? These types of investment are secure as a consequence of a software having a great financial. It usually has a faster stringent otherwise rigid acceptance procedure than a standard financing and you will comes with faster capital immediately following approved. The quality link investment name is actually less than 12 months.

When it is time to sign up for a connection financing, speak to your selected lender to see if he’s willing to provide the financing you desire. Your own financial often feedback their financials and you may credit history before you make an acceptance devotion. After accepted, it’s over to closing where you are able to get the loans requisite to assist bring your company otherwise enterprise using if you don’t receive other financial support.

- Cover the expense out-of a property deals and assets developments, for example repairs and home improvements

- Assist with organization expansions or consolidations

- Financing acquisition of collection getting regular organizations

Even as we touched toward, it is generally meantime resource. So it investment allows the new debtor to own dollars readily available as they safe long lasting capital.

Connection financing analogy

The most famous link loan example is in private or industrial real estate. Whenever operator wants to sell its existing property and buy another one to, they may want to make use of the accumulated guarantee inside their established assets as his or her advance payment toward new one. Prior to this building is sold, that cash is not offered.

So you’re able to connection that pit of time within purchase of a beneficial the newest assets additionally the sales of the old property, a borrower can use a connection mortgage. Once the dated property sells, the bucks throughout the product sales will pay from the financing. Particular individuals, while doing so, tie the brand new bridge amount borrowed within their total loan to blow right back along side longer term.

Link investment for businesses

While using link capital having team investment, a common analogy ‘s the need to loans an enormous buy (eg a property otherwise an item of devices). The fresh downpayment for the get may initial tie up bucks that organization otherwise demands to own functions. In place of a steady stream cash otherwise reputable membership receivable, this will create higher company expansion challenging.

Though a business needs to create a big funded purchase, they are able to utilize this style of financing regarding the meantime because the cash to keep up with expenses expenses or payroll, eg. Upcoming, because big financial support experiences, the business can be come back to working as ever.