Working capital ‘s the lifeblood of your small business-and frequently, your business demands good transfusion to keep alive. Instead of enough earnings available, you could potentially find difficulties level payroll, to purchase collection, or perhaps staying brand new bulbs to your.

Enter working-capital loans. Rather than most other business money choice, a working capital financing are a preliminary-title mortgage built to help your online business defense a short-term cash shortfall, rather than trying out a long-title financing. Payback conditions having business working capital funding typically dont go beyond one year.

How can you determine if working capital capital ‘s the proper option for your organization? Below are a few questions to inquire of oneself before you apply:

Does Working capital Financial support Seem sensible?

Not absolutely all small enterprises are available equal. A different hairdresser shop might have more resource demands than just a beneficial retail store otherwise sale organization. However when you are considering working capital means, all round premises is the same for everybody smaller businesses. Working-capital credit is made to complete short term financial support requires one to happen regarding situations such as for instance regular employs, stimulating your online business insurance coverage, otherwise to order essential provides.

Exactly what are the Financing Requirements?

When it comes to making an application for working-capital financial support, we wish to be given that prepared that one can in advance of addressing loan providers. Every bank provides different conditions to possess resource small businesses, more tight than the others. Query such questions before you apply:

Will you need to put up guarantee? Is there a minimum significance of amount of time in business? Have you figured out your business credit history? How about to include charge records or financial comments?

You’ll be able to speed up the program processes by-doing your hunt and you can making preparations the desired records ahead. Whatsoever, the reason you will be seeking working-capital resource is for a primary cash injections to suit your needs.

Exactly what are the Payment Conditions?

Small company working-capital loan installment words may differ as to what you might be familiar with. Given that it is a smaller-name mortgage, it is critical to see when payment initiate, brand new frequency of these money, and you may if or not there are any additional fees or very early fee charges.

If you’re starting collateral for the loan, ensure you see the particular installment conditions to quit defaulting. And be sure to ask for folks who could be penalized for paying the loan very early. It’s important that you carefully read and you will see the loan’s fees terms to stop economic strain on your company.

Do you know the Different varieties of Working-capital Financial support?

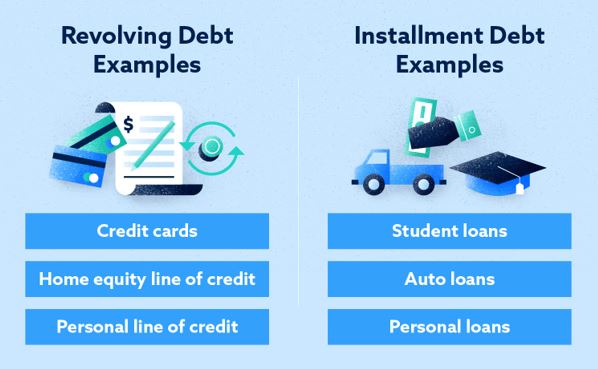

With regards to selecting the most appropriate selection for small company money, the choices shall be daunting. It is critical to installment loan discuss various kinds loans to get the proper fit for your business requires. Some traditional alternatives for small-title resource include:

Working-capital loans: these types of financing is funded into the a lump sum payment that’s following reduced more than a brief period of your time, constantly anywhere between step three in order to 1 year. Working-capital personal lines of credit: having a working-capital line of credit, you’ve got a share from money to get into as required. While pay just appeal toward count make use of. Charge financing: should your working-capital is based on paid invoices, which solution will help release bucks to use for your own businesses daily procedures.

There are plenty of aspects of a small business for taking away a small capital mortgage to store a wholesome cash flow. But with any sort of resource, it’s important to pay attention to the fresh words and requires. When you find yourself a funds shot will assist you to hold the bulbs towards the during a slower stretch, you need to feel convinced its permitting your organization in the long run.