The way you use new HELOC payoff calculator

Play with the house equity credit line (HELOC) payoff calculator to determine the monthly obligations on the household guarantee range considering some other parameters. Use the calculator to learn:

- Exactly how much appeal you can easily spend along side life of their range from borrowing from the bank

- Exacltly what the repayments could well be, as well as how much attract you’ll save, for folks who repay their credit line reduced

- What additional interest rates imply to suit your payment per month

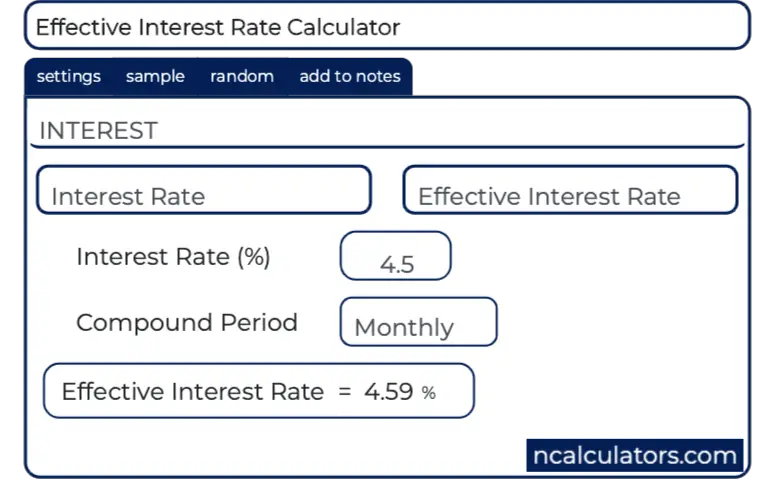

HELOCs was changeable-rates financing, which means your rate of interest may to evolve occasionally. If you are worried about rising pricing, see how far a fixed-rates house collateral mortgage can save you by keeping the pace transform career during the 0 percent.

Refinancing your HELOC into the a property security loan

HELOC money will attract more high priced over time. There are two reasons for having so it: adjustable prices and you may going into the installment stage of your financing.

HELOCs is varying-speed fund, which means that your interest rate tend to to evolve periodically. Into the a surfacing-rates environment, this may suggest large monthly premiums.

Simultaneously, due to the fact draw months finishes individuals are responsible for both the prominent and you may notice. It high increase in the latest monthly HELOC fee will likely be good amaze so you can individuals who had been and also make attention-merely costs on the very first 10 otherwise fifteen years. Possibly the new HELOC fee can also be twice otherwise multiple just what new borrower are purchasing the last a decade.

To save cash, individuals is re-finance its HELOC. Right here we are going to evaluate a couple of choices as well as how it really works.

- Household Collateral Financing – You might take-out a property collateral loan, which includes a fixed rates, and employ the mortgage to settle the HELOC. The main benefit of doing so is you can dodge people speed improvements. The newest downside is that you is guilty of spending closure can cost you.

- The newest HELOC – Sign up for yet another HELOC to restore the existing one. This permits one to prevent you to principal and you will attract commission if you’re looking after your line of credit unlock. When you have enhanced the borrowing from the bank as you had the original HELOC, you can also be eligible for a reduced rate of interest.

While you are looking for refinancing with a HELOC or house security loan, explore Bankrate’s family collateral mortgage costs table observe newest pricing.

Household equity funds versus. HELOCs

Household security money and HELOCs are two type of funds one use the property value your residence once the guarantee. These are typically both believed second mortgage loans. The main difference in her or him is that which have domestic collateral money you earn you to definitely lump sum payment of cash while HELOCs was traces from borrowing that one can mark off as required.

HELOC vs. financial refinance

A HELOC isn’t the only way to help you faucet your house collateral for cash. In addition, you may use a profit-aside re-finance to improve currency having renovations and other uses. A profit-away refi changes your existing financial with a new home loan that is larger than your a good equilibrium. Obtain the difference when you look at the a lump sum of cash whenever new financing closes.

In the 2021, whenever financial prices was on number lows, the latest smart circulate was to simply take a money-away refi and you may secure an excellent-low rate. Since the mortgage prices features twofold from inside the 2022, a finances-away refi no longer is always a knowledgeable tip. For folks who closed during the a home loan price out Clanton loans of step 3 percent, such as, an alternate dollars-out refinance today probably won’t add up.

Good HELOC are going to be the right choice if you are happy with this new terms of your current home loan and do not need a unique financial. A beneficial HELOC along with is likely to come with fewer costs and you may closing will set you back than simply an earnings-aside refi.