- Continuously arranged loan repayments from professionals already for the federal service is actually produced by way of payroll write-offs. Their payroll place of work could well be notified to start deducting loan money out of your salary when your financing has been canned. Mortgage payments should begin 60 days just after financing disbursement but could begin prior to.

- Youre responsible for making certain your payments try filed into the go out, maybe not your employer. Make sure that your repayments undergo each month by the checking their payroll.

- Its extremely important that the target is up to go out to timely located notifications about the status from the loan. Ensure that your agencies keeps your best address. This is particularly important to inform for those who transform address or providers.

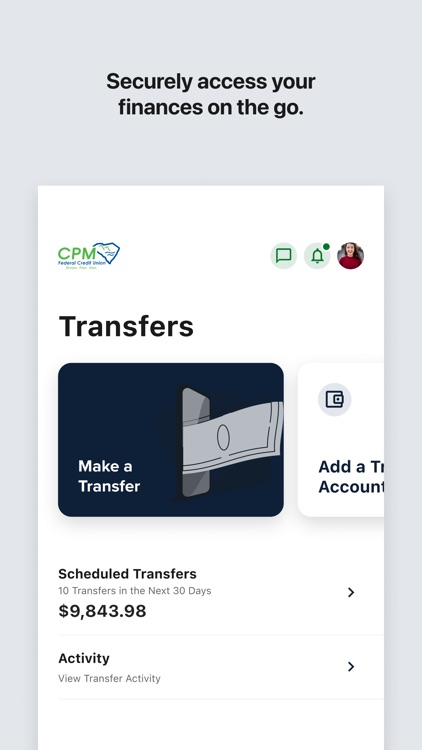

- Information on your loan would-be reported in your quarterly and you will yearly statements. You could glance at details about your loan from the log in back at my Membership with the .

- For many who alter providers otherwise payroll practices you should tell your brand new institution or service you have a teaspoon loan and illustrate them to consistently loan payments. You are responsible for distribution loan money truly until your new department or services initiate subtracting payments out of your pay. For folks who switch to a different shell out cycle, you should log on to My Account on boost new guidance so your loan commission usually match your new get redirected here agenda. Think of, switching organizations can indicate your house address has changed. Make sure you improve your address by the logging in back at my Account towards the .

- You can make even more loan repayments because of the examine, currency buy, or direct debit any time to settle your loan easier or to make up for missed money.

- You can repay your loan entirely at any time as opposed to an installment penalty.

- You cannot avoid mortgage costs. For many who independent regarding federal services or get into nonpay standing which have a great financing balance you may also approve lead debits from the bank.

- For those who enter nonpay reputation excite find out more about nonpay updates has an effect on the loan by going to this connect . Find web page several, Appendix, How Nonpay Reputation Impacts Their Teaspoon Account.

Limitation Financing Label Constraints

Whenever paying down the loan, you may have 60 days to repay a general mission loan and you can 180 days to repay a primary residence financing back in complete. Not paying straight back the loan because of the title limit have a tendency to bring about your own delinquent harmony becoming nonexempt money. Considerably more details about it are in the latest section Financing delinquency lower than.

Loan Delinquency

Depending on , the complete outstanding equilibrium of your own mortgage was announced because a great taxed financing in both of the after the activities:

Sadly, while you are in a choice of of your significantly more than products, this new Irs will eliminate the amount of the unpaid mortgage just like the nonexempt income. When you find yourself under the age of 59 and ? you’ll also end up being susceptible to the new ten% very early detachment penalty taxation. Remember that an excellent taxed financing forever has an effect on your Teaspoon balance unless it is repaid and certainly will apply to your own eligibility for the next mortgage.

If any element of your own taxed financing are of Roth or tax-exempt contributions , those people contributions will never be at the mercy of income tax. not, any money of them benefits might be taxed even if you meet the a few criteria wanted to qualify for income tax-free Roth earnings (select the Roth versus. Conventional sum investment blog post).

Even in the event the loan will get nonexempt, you may also always pay it off if you will always be a national personnel. When you separate of government service your nonexempt financing will no stretched become repayable.

A word of Caution

When you take a tsp loan, your obtain from your own membership. As you often pay-off the cash and attention for you personally, understand that the eye you pay could be less than new earnings that may keeps accrued if you had kept the cash on your own Teaspoon account.

As you can plainly see, Teaspoon loans is difficult. It’s important to read the small print prior to taking aside a loan so you know about all possible outcomes.

The majority of this post is from possesses come condensed to suit your simple learning. If you need to read through a lot more about Tsp finance, click on the pursuing the hook: .

DISCLAIMER: Every piece of information given in this post is for general suggestions purposes and contains started taken from sources sensed credible. All the info may not protection all aspects out-of book factors otherwise government legislation. All the details is offered for the with the knowledge that new creator and publisher commonly involved with helping to make court, accounting, or other top-notch properties. Neither the newest author nor the author in the blog post would be held accountable for all the losings or damages incurred. Teaspoon Airplane pilot is not connected to the us government.